ZK International’s xSigma Corp. Plans to Launch xSigma Wallet: A Crypto Platform for Buying Memecoins & Digital Assets with Credit Cards

WENZHOU, China, Jan. 31, 2025 /PRNewswire/ — ZK International Group Co., Ltd. (Nasdaq: ZKIN) (“ZK International” or the “Company”), is pleased to announce that its subsidiary, xSigma Corp., continues its commitment to technological advancements by planning the launch of xSigma Wallet, a next-generation crypto banking wallet that will enable users to seamlessly buy memecoins and cryptocurrencies using Visa / Mastercard credit cards, Apple Pay, PayPal, and Google Pay.

As part of this initiative, xSigma Wallet will also introduce its own xSigma Visa credit card, allowing users to top up their balance with crypto, providing greater accessibility and flexibility for digital asset holders.

A FinTech Platform Built for Security & Convenience

xSigma Wallet will be regulated in the U.S. and serve customers in over 170 countries, ensuring compliance with financial regulations while providing users with a secure and trusted digital asset experience. The wallet is being developed by the xSigma team, with regulated financial services provided by a white-label provider.

Key Features of xSigma Wallet:

- Buy Crypto & Memecoins – Users can purchase popular cryptocurrencies instantly with credit cards and Apple Pay.

- xSigma Visa Credit Card – A crypto-backed Visa card, enabling users to spend their digital assets easily.

- Secure & Regulated – Registered in the U.S., ensuring a compliant financial framework.

- White-Labeled Platform – Designed to be branded and operated under xSigma’s ecosystem.

- Non-Custodial Storage – xSigma will offer a secure, non-custodial way to store memecoins and major cryptocurrencies.

- On-Ramp Services – The wallet will provide simple fiat-to-crypto on-ramp services, allowing users to buy memecoins with minimal effort.

- Strategic Partnerships – xSigma plans to partner with various memecoins to become their official on-ramping partner.

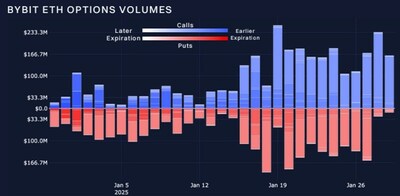

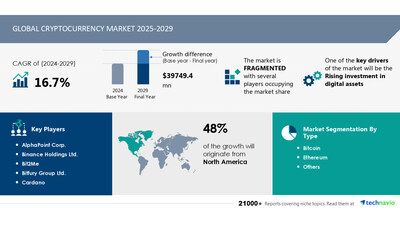

Strong Market Demand for Memecoins & On-Ramp Services

The recent traction of Trump’s memecoin and Moonshot, a competing app that processed a record-breaking $400 million in trading volume on day one, indicates a strong demand for seamless on-ramp services for assets like memecoins. xSigma Wallet aims to meet this growing need by offering a frictionless and compliant way to purchase, store, and spend digital assets.

“At xSigma, we are committed to driving innovation in the digital asset space,” said Mr. Huang Jiancong, Chairman of ZK International. “The launch of xSigma Wallet is a major step forward in providing users with a secure, regulated, and user-friendly way to engage with cryptocurrencies and memecoins. As the market evolves, we aim to set the standard for compliant and seamless on-ramp solutions.”

Looking Ahead

The launch of xSigma Wallet represents another milestone in xSigma Corp.’s strategy to stay relevant in blockchain innovation and the digital infrastructure of tomorrow. More details, including launch dates and platform availability, will be announced in the coming months.

For more information please visit www.ZKInternationalGroup.com. Additionally, please follow the Company on Twitter, Facebook, YouTube, and Weibo. For further information on the Company’s SEC filings please visit www.sec.gov.

About xSigma Corp.

xSigma Corp. is a blockchain R&D lab and a subsidiary of ZK International Group Co., Ltd. (Nasdaq: ZKIN). The company focuses on decentralized finance (DeFi), blockchain-based payments, and financial technology innovations.

About ZK International Group Co., Ltd.:

ZK International Group Co., Ltd. is a China-based engineering company building and investing in innovative technologies for the modern world. With a focus on designing and implementing next-generation solutions through industrial, environmental and software engineering, ZKIN owns 28 patents, 21 trademarks, 2 Technical Achievement Awards, and 10 National and Industry Standard Awards.

ZKIN’s core business is to engineer and manufacture patented high-performance stainless steel and carbon steel pipe products that effectively deliver high quality, highly-sustainable and environmentally sound drinkable water to the Chinese, Asia and European markets. ZK International is Quality Management System Certified (ISO9001), Environmental Management System Certified (ISO1401), and a National Industrial Stainless Steel Production Licensee. It has supplied stainless steel pipelines for over 2,000 projects, which include the Beijing National Airport, the “Water Cube” and “Bird’s Nest”, which were venues for the 2008 Beijing Olympics. ZK International is preparing to capitalize on the $850 Billion commitment made by the Chinese Government to improve the quality of water, which has been stated to be 70% unfit for human contact.

Safe Harbor Statement

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict and many of which are beyond the control of ZK International. Actual results may differ from those projected in the forward-looking statements due to risks and uncertainties, as well as other risk factors that are included in the Company’s filings with the U.S. Securities and Exchange Commission. Although ZK International believes that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance that the results contemplated in forward-looking statements will be realized. In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by ZK International or any other person that their objectives or plans will be achieved. ZK International does not undertake any obligation to revise the forward-looking statements contained herein to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/zk-internationals-xsigma-corp-plans-to-launch-xsigma-wallet-a-crypto-platform-for-buying-memecoins–digital-assets-with-credit-cards-302365311.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/zk-internationals-xsigma-corp-plans-to-launch-xsigma-wallet-a-crypto-platform-for-buying-memecoins–digital-assets-with-credit-cards-302365311.html

SOURCE ZK International Group Co., Ltd.

Featured Image: Unplash @ Kanchanara