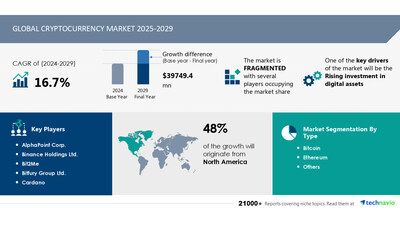

NEW YORK, Jan. 30, 2025 /PRNewswire/ — Report with market evolution powered by AI – The global cryptocurrency market size is estimated to grow by USD 39.75 billion from 2025-2029, according to Technavio. The market is estimated to grow at a CAGR of 16.7% during the forecast period. Rising investment in digital assets is driving market growth, with a trend towards acceptance of cryptocurrency by retailers. However, volatility in value of cryptocurrency poses a challenge. Key market players include AlphaPoint Corp., Binance Holdings Ltd., Bit2Me, Bitfury Group Ltd., Cardano, CEX.IO Corp., Coinbase Global Inc., DOGECOIN, FMR LLC, Gemini Trust Co. LLC, KuCoin, Ledger SAS, Marathon Digital Holdings, Pantera Capital, PT Pintu Kemana Saja, Riot Platforms Inc., Ripple Labs Inc., Shiba Inu, Valora Inc., WazirX, and Xapo Bank Ltd..

AI-Powered Market Evolution Insights. Our comprehensive market report ready with the latest trends, growth opportunities, and strategic analysis- View Free Sample Report PDF

Forecast period | 2025-2029 |

Base Year | 2024 |

Historic Data | 2019 – 2023 |

Segment Covered | Type (Bitcoin, Ethereum, and Others), Component (Hardware and Software), Geography (North America, Europe, APAC, South America, and Middle East and Africa). |

Region Covered | North America, Europe, APAC, South America, and Middle East and Africa |

Key companies profiled | AlphaPoint Corp., Binance Holdings Ltd., Bit2Me, Bitfury Group Ltd., Cardano, CEX.IO Corp., Coinbase Global Inc., DOGECOIN, FMR LLC, Gemini Trust Co. LLC, KuCoin, Ledger SAS, Marathon Digital Holdings, Pantera Capital, PT Pintu Kemana Saja, Riot Platforms Inc., Ripple Labs Inc., Shiba Inu, Valora Inc., WazirX, and Xapo Bank Ltd. |

Key Market Trends Fueling Growth

Cryptocurrencies, like Bitcoin and Ethereum, are digital currencies based on decentralized technology called Blockchain. This technology enables secure, transparent transactions without the need for intermediaries. Global adoption of cryptocurrencies is on the rise, with Ethereum leading the charge as a popular platform for decentralized applications. However, price volatility remains a concern, along with cybersecurity risks and theft. Regulatory outlooks vary, with some countries embracing the digital revolution and others cautious. Energy consumption and environmental effects are also topics of debate. Skilled developers are in high demand for financial services and cryptocurrency projects. Consumer protection and financial stability are key concerns, with scams and fraudulent investments a risk. Renewable energy and blockchain talent are driving innovation. Cryptography and encryption ensure secure transactions, while decentralized systems offer transparency through public ledgers. Altcoins, mining, digital wallets, and trading are part of the cryptocurrency landscape. Brokers, cryptocurrency exchanges, and payment methods like ACH transfers and wire transfers facilitate transactions. Fiat currency, Bitcoin trusts, mutual funds, and stocks offer investment opportunities. Cryptocurrencies are used in e-commerce, luxury goods, insurance payments, and more. Security is paramount, with hot and cold wallets providing different levels of protection. Be wary of crypto scams, fraud, and romance scams.

The adoption of cryptocurrencies like Bitcoin and Ether has gained traction among the public, businesses, and merchants for everyday transactions. In 2022, the usage of cryptocurrencies by major retailers, such as Starbucks, enhanced public acceptance and trust. Previously, cryptocurrencies were utilized for purchasing cars and ordering food and groceries. Companies like Starbucks currently accept cryptocurrency payments through third-party exchanges, such as iPayYou, which convert cryptocurrencies to cash. Starbucks Corporation (Starbucks) may consider accepting direct cryptocurrency payments in the future. In April 2022, Starbucks introduced Non-Fungible Tokens (NFTs) and cryptocurrencies as payment methods in their stores.

Insights on how AI is driving innovation, efficiency, and market growth- Request Sample!

Market Challenges

- Cryptocurrency markets present significant opportunities for businesses and individuals in the digital revolution. However, they come with challenges. Decentralized currencies like Bitcoin and Ethereum face price volatility, cybersecurity risks, and theft. Regulatory outlooks vary globally, impacting adoption. Energy consumption and environmental effects are concerns. Skilled developers are in high demand for blockchain technology and cryptography. Financial services seek to integrate digital assets into their offerings, but consumer protection and financial stability are crucial. Digital wallets and trading platforms require security. Price volatility and scams, including romance scams and fraudulent investments, pose risks. Renewable energy and blockchain talent offer solutions. Businesses must navigate this complex landscape carefully, considering investment vehicles like Bitcoin trusts and mutual funds, and the role of cryptocurrency in e-commerce, luxury goods, insurance payments, and more.

- Cryptocurrencies, such as Bitcoin, exhibit extreme volatility due to the large amount controlled by a small group of investors who frequently trade on platforms and exchanges. In June 2022, Bitcoin experienced a significant 10% decrease in value, dropping from its November 2021 high of USD69,000 per token. This decline was influenced by the Indian government’s announcement to ban cryptocurrencies and introduce their own digital currency. Low-risk investors generally avoid including cryptocurrencies in their portfolios due to this unpredictable market behavior.

Insights into how AI is reshaping industries and driving growth- Download a Sample Report

Segment Overview

This cryptocurrency market report extensively covers market segmentation by

- Type

- 1.1 Bitcoin

- 1.2 Ethereum

- 1.3 Others

- Component

- Geography

- 3.1 North America

- 3.2 Europe

- 3.3 APAC

- 3.4 South America

- 3.5 Middle East and Africa

1.1 Bitcoin– Bitcoin, the world’s leading digital currency, boasts a market capitalization of over USD470 billion, making it the largest cryptocurrency by far. With 95% recognition among interested parties, Bitcoin operates as a decentralized, peer-to-peer (P2P) digital currency, bypassing the need for central authorities. Four other top cryptocurrencies, Tether, USD Coin, Binance USD, and DAI, are pegged to the US dollar. In the US, approximately 8% of the population engages in cryptocurrency trading. Bitcoin‘s popularity fuels the expansion of the global cryptocurrency market, as all transactions are recorded on a secure, decentralized public ledger called the blockchain.

Download complimentary Sample Report to gain insights into AI’s impact on market dynamics, emerging trends, and future opportunities- including forecast (2025-2029) and historic data (2019 – 2023)

Research Analysis

Cryptocurrencies, based on blockchain technology, represent a decentralized form of digital currency that operates outside of traditional financial institutions. Ethereum, one of the leading platforms, enables the creation of decentralized applications. Global adoption of cryptocurrencies is growing, but price volatility remains a significant challenge. Cybersecurity and theft risk are concerns, with regulatory outlooks varying worldwide. Energy consumption is a topic of debate, with some arguing that renewable energy sources can mitigate environmental effects. Skilled developers are in high demand for creating and maintaining these systems, and financial services are increasingly integrating cryptocurrencies. The digital revolution brings opportunities for consumer protection and financial stability, but also risks of scams and fraudulent investments. Transactions are recorded on a public ledger, ensuring transparency, while cryptography and a decentralized system provide security. Bitcoin, Ethereum, Litecoin, Ripple, and altcoins are the most well-known cryptocurrencies.

Market Research Overview

The cryptocurrency market is a decentralized economy fueled by blockchain technology, where digital currency transactions are recorded on a public ledger. Ethereum, the second-largest cryptocurrency, powers smart contracts and decentralized applications. Global adoption of cryptocurrencies is on the rise, but price volatility remains a concern. Cybersecurity and theft risk are significant challenges, with regulatory outlooks varying worldwide. Energy consumption and environmental effects are also topics of debate. Skilled developers are in high demand to build the next generation of financial services and digital assets. Consumer protection and financial stability are crucial as cryptocurrencies become more mainstream. Blockchain technology offers encryption, decentralized systems, and secure transactions, but scams, fraudulent investments, and thefts persist. Renewable energy and blockchain talent are key to reducing the environmental impact of cryptocurrency mining. Trading, brokers, and cryptocurrency exchanges provide various payment methods, including fiat currency transfers and digital wallets. Cryptocurrencies are used for e-commerce, luxury goods, insurance payments, and even as investments through trusts, mutual funds, and stocks. However, the market is riddled with scams, fraud, and romance scams, making it essential to exercise caution.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Type

- Component

- Geography

- North America

- Europe

- APAC

- South America

- Middle East And Africa

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/cryptocurrency-market-to-grow-by-usd-39-75-billion-2025-2029-rising-investment-in-digital-assets-to-boost-revenue-report-on-ai-driving-market-transformation—technavio-302363638.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/cryptocurrency-market-to-grow-by-usd-39-75-billion-2025-2029-rising-investment-in-digital-assets-to-boost-revenue-report-on-ai-driving-market-transformation—technavio-302363638.html

SOURCE Technavio

Featured Image: depositphotos @ monsit

Disclaimer

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lavenhill-securities-limited-leverages-spacex-momentum-to-explore-cryptocurrencies-and-blockchain-technology-302364411.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lavenhill-securities-limited-leverages-spacex-momentum-to-explore-cryptocurrencies-and-blockchain-technology-302364411.html