Markets Show Resilience Ahead of End-of-Year Options Expirations: Bybit x Block Scholes Crypto Derivatives Report

DUBAI, UAE, Dec. 26, 2024 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, released the latest Crypto Derivatives Analytics Report in collaboration with Block Scholes, highlighting the muted market volatility despite major options expirations on Friday. BTC and ETH’s realized volatility has increased, but short-term options haven’t adjusted to this change. This indicates that while spot prices are fluctuating, the options market is not fully reacting to these shifts, although BTC and ETH volumes have displayed slightly different patterns.

With more than $525 million in BTC and ETH options contracts expiring on Dec 27, 2024’s end-of-year options expiration looks set to be one of the biggest yet, yet expectations for volatility have remained subdued. The report highlights an unusual inversion in ETH’s volatility structure, but BTC has not mirrored the reaction. Additionally, a change in funding rates—sometimes turning negative as spot prices drop—signals a new market phase. Notably, BTC’s volatility structure has been less responsive to changes in spot prices, whereas ETH’s short-term options are exhibiting more noticeable fluctuations.

Key Findings:

BTC Options Expirations:

In the past month, BTC’s realized volatility has been higher than implied volatility on three occasions, each time reaching a relatively calm equilibrium. Open interest in BTC options remains high, contributing to potential increased volatility as we near the end of the year. Around $360 million worth of BTC options (both puts and calls) are set to expire soon, which can affect price movement.

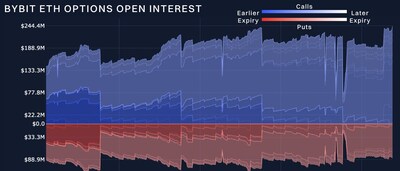

ETH Options: Calls Dominate

Despite a mid-week inversion, ETH’s volatility term structure has flattened, maintaining levels similar to those seen over the past month. In the final week of 2024, calls overwhelmed puts in open interest in ETH options, although market movements and trading activities are more on the put side.

Access the Full Report:

Gain deeper insights and explore the potential impacts on your crypto trading strategies by downloading the full report here: Bybit X Block Scholes Crypto Derivatives Analytics Report (Dec 24, 2024)

#Bybit / #BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For media inquiries, please contact: media@bybit.com

For more information, please visit: https://www.bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://www.007stockchat.com/wp-content/uploads/2024/12/Sources_Bybit_Block_Scholes.jpg

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/markets-show-resilience-ahead-of-end-of-year-options-expirations-bybit-x-block-scholes-crypto-derivatives-report-302339299.html

View original content:https://www.prnewswire.co.uk/news-releases/markets-show-resilience-ahead-of-end-of-year-options-expirations-bybit-x-block-scholes-crypto-derivatives-report-302339299.html

Featured Image: depositphotos @ KostyaKlimenko