Grexie Signchain Launches on November 1st, 2024: Enabling Smart Contract Developers to Bring Off-Chain Data On-Chain with Seamless Gas-Paid Signing

Grexie Signchain enables developers to sign off-chain data into smart contracts, with self-hosted or secure vault signer wallet management.

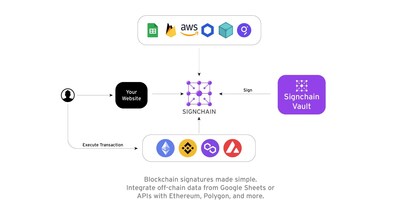

MANCHESTER, England, Oct. 17, 2024 /PRNewswire/ — Grexie Limited proudly announces the launch of its innovative smart contract solution, Signchain, on November 1st, 2024. Designed specifically for developers, Signchain introduces a powerful way to bring off-chain data on-chain through user-paid gas fees and secure signing of data into smart contract methods using its extendable smart contract, Signable.

In the growing landscape of blockchain technology, securely managing off-chain data and integrating it into on-chain smart contracts has posed significant challenges for developers. Signchain eliminates these hurdles by offering a robust, gas-efficient system for signing and authenticating data in real-time.

Key Features of Signchain:

1. Seamless Off-Chain to On-Chain Data Integration

Signchain enables developers to securely bring off-chain data on-chain by signing it directly into smart contract methods through user-paid gas fees. This integration ensures that data authenticity is preserved, and its entry into the blockchain remains tamper-proof, streamlining processes for industries relying on real-world data verification. Signchain also supports integration with Google Sheets, AWS, and Firebase, making it easy to pull data from popular off-chain data sources.

2. Extendable Smart Contract – Signable

The core of Signchain’s technology is its extendable smart contract, Signable, which allows developers to customize and build upon existing smart contracts. With Signable, developers can easily implement contract signatures for any data type, offering flexibility across industries from finance to logistics and beyond.

3. Signer Wallet Management

Signchain offers comprehensive signer wallet management as part of its service, empowering developers to manage and authenticate signers effectively. Wallets can either be self-hosted using Signchain’s Docker container for those who prefer their own infrastructure, or they can leverage Signchain’s network of secure vaults for maximum security.

4. Self-Hosted or Managed Service

For developers who want full control of their infrastructure, Signchain provides a self-hosted option via Docker containers, allowing them to deploy the platform on their own servers. Alternatively, developers can opt to use Signchain’s secure vault network, offering a hassle-free solution with enterprise-grade security and wallet management.

5. User-Paid Gas Fees

By integrating a user-paid gas fee model, Signchain allows users to cover the costs of signing and authenticating their data, ensuring the signing process is efficient and doesn’t overburden developers with additional expenses. This makes Signchain an ideal solution for dApps and platforms handling high transaction volumes.

6. Google Sheets, AWS, Firebase Integration with Serverless Model

Signchain supports integration with Google Sheets, AWS, and Firebase in a serverless model, powered by a hosted Sign In With Ethereum (SIWE) implementation provided by Signchain’s API. Developers can simply connect their Google Sheets and configure the contract parameters associated with each column. Signchain will automatically look up the user’s wallet address in the spreadsheet, sign the transaction data, and execute it in the blockchain along with any user-supplied parameters. This creates an easy, efficient way to manage data inputs from off-chain sources without heavy infrastructure setup.

Revolutionizing Smart Contract Workflows

With Signchain, developers now have the tools to handle the complexities of integrating off-chain data into smart contracts. The extendable nature of Signable offers flexibility, allowing developers to cater to various use cases, whether it’s automating financial transactions, supply chain data, or verifying legal agreements.

Tim Behrsin, CEO of Grexie Limited, said, “Signchain is more than just a signing solution—it’s a platform that empowers developers to securely integrate off-chain data into their smart contracts with minimal effort. The flexibility of Signable and our focus on signer wallet management offers developers control and security at every stage of the process.”

Why Signchain Matters

Signchain addresses critical challenges faced by developers, particularly those dealing with off-chain data. By signing data into smart contracts and enabling user-paid gas fees, the platform significantly reduces friction in managing secure, scalable smart contracts. Whether developers need to manage high volumes of data transactions or create bespoke smart contracts, Signchain offers a scalable and secure solution.

In industries like DeFi, real estate, and supply chain management, data integrity and security are paramount. Signchain’s secure vault network and customizable signing workflows allow businesses to handle sensitive information with confidence.

Launch Event and Future Developments

The official launch of Signchain will take place on November 1st, 2024, alongside a virtual event. The event will showcase live demonstrations of Signable, with detailed walkthroughs of the Docker-based self-hosted solution and signer wallet management features. Attendees will also get an exclusive preview of future enhancements, including multi-signature workflows and advanced blockchain network integrations.

About Signchain

Signchain is a cutting-edge platform developed by Grexie Limited, based in Manchester, Cheshire, United Kingdom. Signchain simplifies smart contract development by offering a secure, scalable, and customizable solution for signing and authenticating off-chain data on-chain. Developers can either self-host the solution using Signchain’s Docker container or rely on the network’s secure vault infrastructure. With an emphasis on security, flexibility, and developer experience, Signchain is set to transform how smart contracts handle off-chain data.

For more information, visit signchain.net.

Logo – https://www.007stockchat.com/wp-content/uploads/2024/10/Signchain_Logo.jpg

Photo – https://www.007stockchat.com/wp-content/uploads/2024/10/Signchain_flow.jpg

PDF – https://mma.prnewswire.com/media/2533539/Signchain_Whitepaper.pdf

SOURCE Grexie Limited

Featured Image: Unplash @ fabioha